Bond rate of return formula

We Provide Tools Research Support To Help Take the Guesswork Out Of Bonds Investing. Explore high-yield bond funds in the fixed-income market with a 7 day free trial.

Bond Yield Calculator

RET e F-PP Where RET e is the expected rate of return F the bonds.

. Ad We Offer a Wide Range Of Fixed-Income Investments That May Address Your Needs. The rate of interest which is used to discount the future cash flows is known as the yield to maturity YTM Bond Price i1n C 1rn F 1rn or Bond Price C 1- 1r-nr F. Annual Rate of Return End of year price Beginning of year price Beginning of year price x 100 For example if an investment is worth 70 at the end of the year.

If the rate of interest currently is 8 the value of the bond is Rs. Ad Build a resilient portfolio with Morningstar Investors independent bond research. If youve held a bond over a long period of time you might want to calculate its annual percent return or the percent return divided by the number of years youve held the.

Of Years to Maturity. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t. Ad Explore funds and choose those that align with your clients goals.

IRR internal rate of return t period from 0 to last period -or- 0 initial outlay 1 CF1 1 IRR1 CF2 1 IRR2. To calculate the annual rate of return on a bond divide the bonds interest earned and price appreciation by the bonds value at the beginning of the year. CFX 1 IRRX Using the above examples.

The value of the bond is determined as follows. On the other hand the term current yield. WACC Weighted average cost of capital firm-wide required rate of return W d Weight of debt k d.

A number of funds have earned 4- and 5-star ratings. 250 20 200 200 x 100 35 Therefore Adam realized a 35 return on his shares over the two-year period. WACC W d k d 1 t W p s k p s W c e k c e where.

1000 and if it is 9 it is 88888 and if it is 10 the. V 1I 8009 88848. Required Rate of Return formula Expected dividend payment Stock price Forecasted dividend growth rate The required return equation utilizes the risk-free rate of return and the market rate.

Plug all the numbers into the rate of return formula. The formula for annual return is expressed as the value of the investment at the end of the given period divided by its initial value raised to the number of years reciprocal and then minus one. Composite rate fixed rate 2 x semiannual inflation rate fixed rate x semiannual inflation rate 00000 2 x 00481 00000 x 00481 Composite rate.

Our funds have star power. Price of bond is calculated using the formula given below Bond Price Cn 1YTMn P 1in Bond Price 60 11 60 11 2 60 11 3 60 11 4 60 11 5 60. Calculating the Expected Return The expected return on a bond can be expressed with this formula.

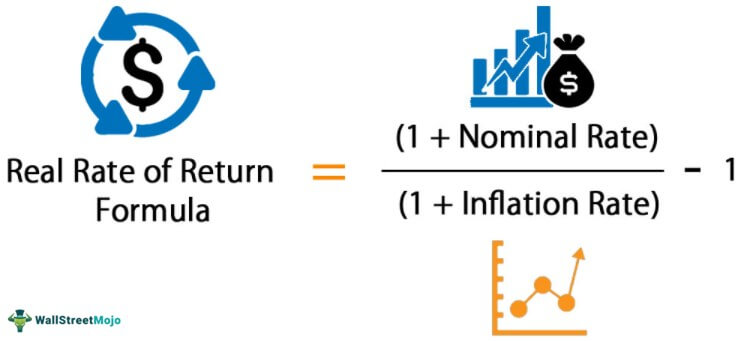

Real Rate Of Return Definition Formula How To Calculate

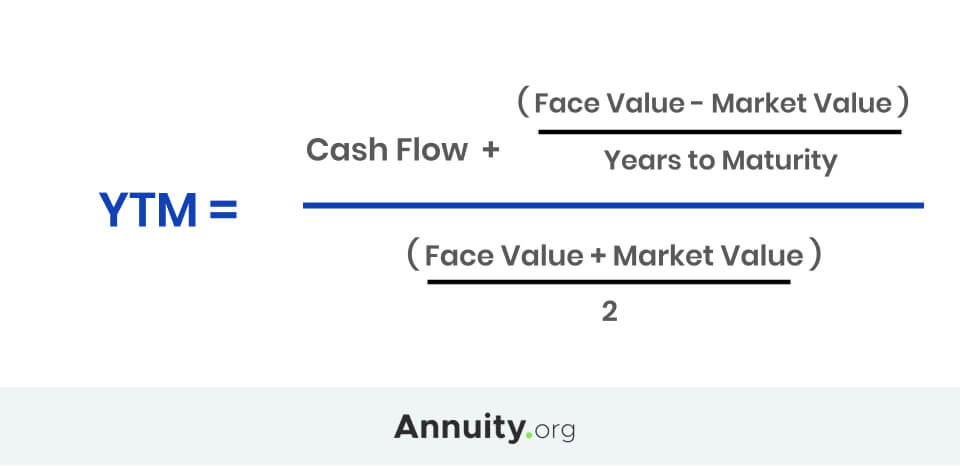

Yield To Maturity Ytm Formula And Calculator Excel Template

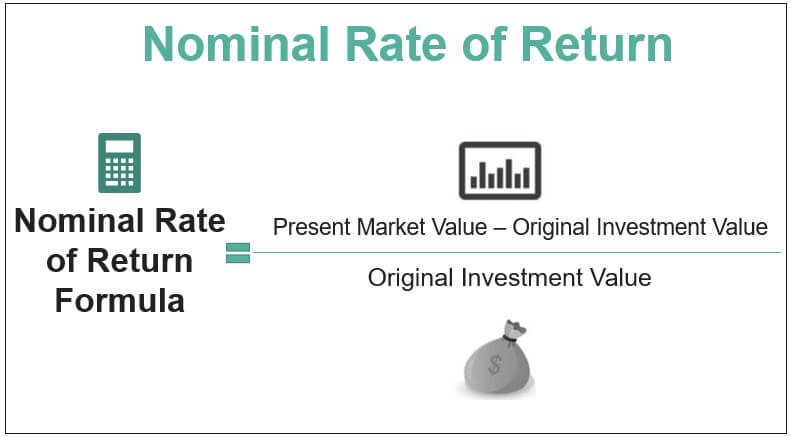

Nominal Rate Of Return Definition Formula Examples Calculations

Bond Yield Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Yield To Call Ytc Bond Formula And Calculator Excel Template

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Coupon Rate Formula Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template

Yield To Maturity Approximate Formula With Calculator

Bond Yield Calculator

Zero Coupon Bond Yield Formula With Calculator

Bond Yield Formula Calculator Example With Excel Template

Yield Curve How Yield Curve Changes Affect Annuities

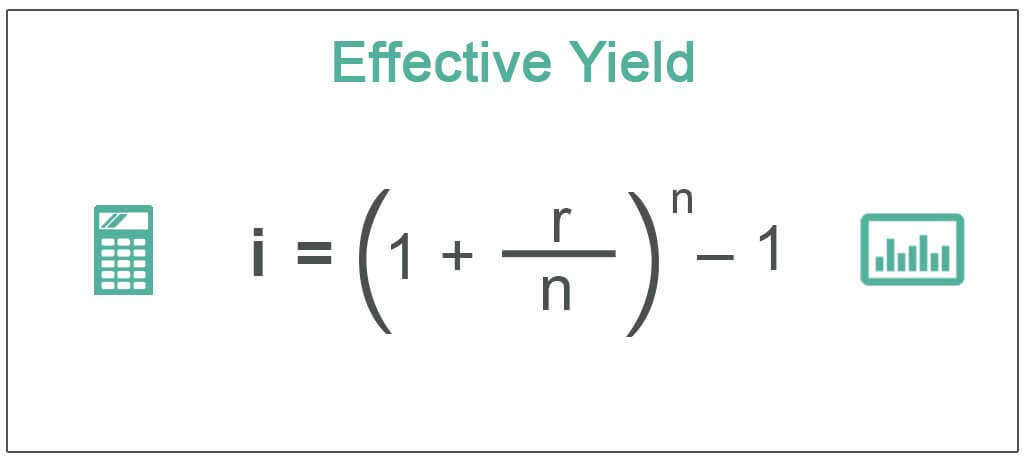

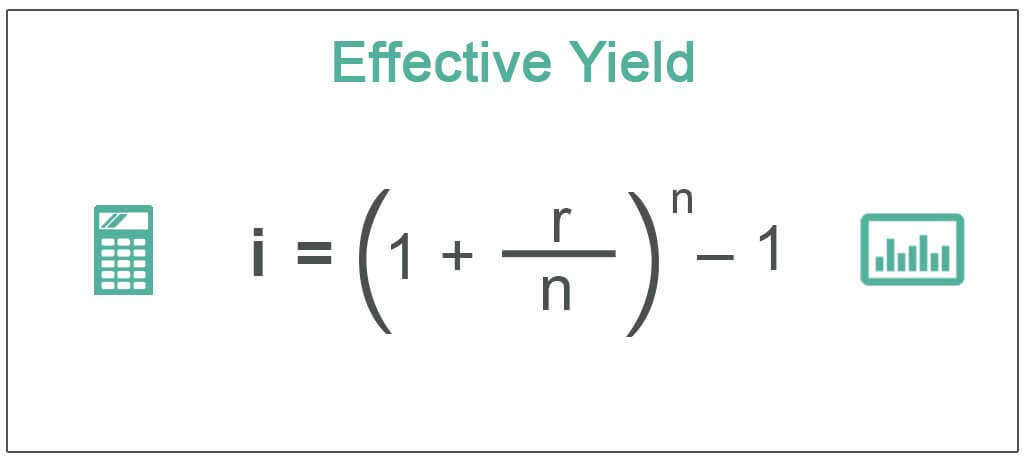

Effective Yield Definition Formula How To Calculate

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy